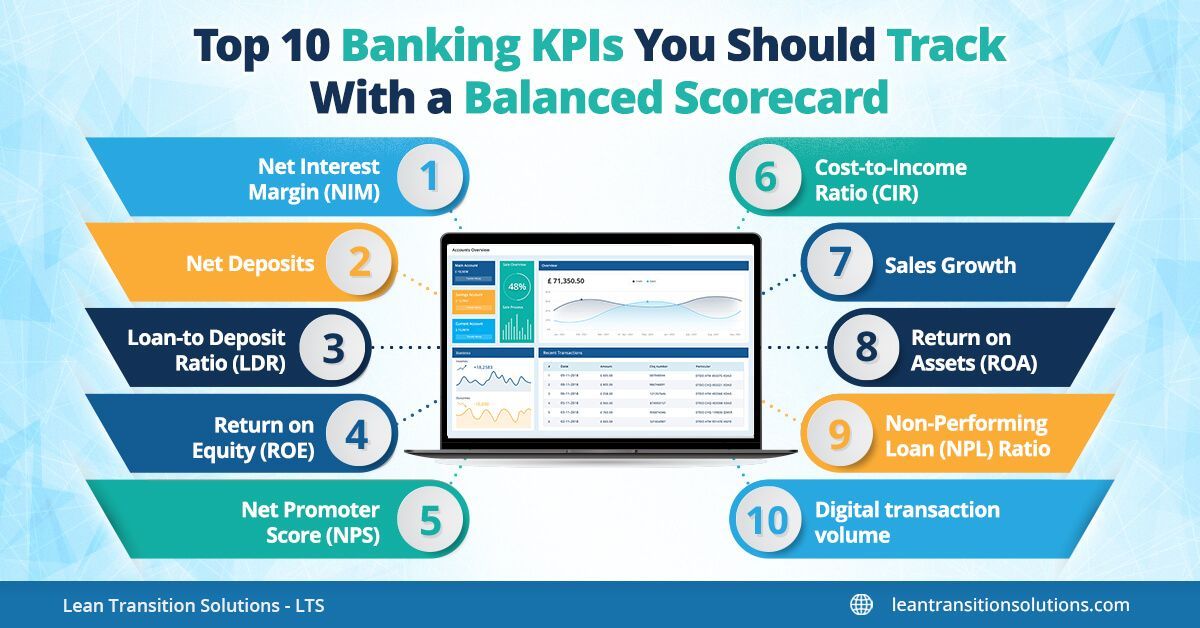

Top 10 banking KPIs you should track with a Balanced Scorecard

February 28, 2025

Are you managing a bank under the current conditions where the financial markets fluctuate, customer demands are changing, and competition intensifies more rapidly than ever? The banking environment is vibrant and challenging and the only way to sustain an edge requires more than just instinct —which is quantifiable analysis. The sole of achieving success through quantifiable analysis is measuring your relevant banking Key Performance Indicators (KPIs). In this blog, we will discuss the ten important banking KPI examples for improved banking performance.

Wondering how to structure and track your financial KPIs effectively? A well-defined BSC framework template can help map out objectives, measures, targets, and initiatives in one view, making performance more visible and manageable. That’s where the LTS Data Point Balanced Scorecard makes all the difference for the financial sector. Built on the Balanced Scorecard approach, Data Point Balanced Scorecard for financial services is designed to accurately track and evaluate banking KPIs with precision and clarity.

Data point Balanced Scorecard for financial services aimed at tracking and evaluating banking KPIs accurately and offering a complete performance analysis solution in real-time.