What is a Balanced Scorecard in the Banking Sector?

A Balanced Scorecard in the banking sector is a strategic management framework that translates a financial institution's mission and objectives into a comprehensive set of performance indicators across its four key perspectives: Financial, Customer, Internal processes, and Learning & Growth (FCIL). In the banking industry, scorecards allow for a holistic performance assessment by integrating financial metrics, customer satisfaction, operational efficiency, and employee development into a single visual platform. By aligning these perspectives, the Balanced Scorecard enables banks to monitor and improve their overall strategic performance, fostering a balanced approach to decision-making and ensuring that the financial organisation meets its goals effectively and sustainably.

How can the Banking Industry benefit from using a Balanced Scorecard?

- Comprehensive Performance Measurement: The Banking Balanced Scorecard provides a holistic approach to performance measurement in the banking industry, incorporating key indicators from Financial, Customer, Internal processes, and Learning & Growth perspectives.

- Strategic Alignment: It ensures alignment between the bank's strategic goals and day-to-day operations, promoting a cohesive and purposeful organisational strategy.

- Enhanced Decision-Making: The Balanced Scorecard facilitates data-driven decision-making by offering a balanced view of various aspects, empowering banking executives to make informed choices.

- Improved Customer Satisfaction: By tracking and analysing customer-focused metrics, the Banking Balanced Scorecard enables banks to enhance service quality, increasing customer satisfaction and loyalty.

- Operational Efficiency: It identifies inefficiencies in internal processes, allowing banks to streamline operations and optimise resource allocation for improved overall efficiency.

- Risk Management: The Balanced Scorecard aids in identifying and managing risks within banking operations, contributing to a more resilient and secure financial environment.

- Employee Development: Through the learning & growth perspective, the Balanced Scorecard supports employee development initiatives, ensuring a skilled and motivated workforce in banks.

- Transparency and Accountability: Implementing a Balanced Scorecard promotes transparency by clearly communicating financial goals and performance metrics, fostering a culture of accountability within the banking sector.

- Continuous Improvement: The system encourages continuous improvement, as regular reviews of finance metrics lead to iterative refinements in strategies and processes.

Four perspectives of Balanced Scorecard for Financial Organisations

The Banking Balanced Scorecard comprises four key perspectives, providing a comprehensive performance measurement and strategic management framework. In financial organisations, the Balanced Scorecard ensures a well-rounded approach to performance management by considering financial outcomes, customer satisfaction, internal processes, and technological development. The balanced perspectives help align various aspects of the financial organisation, fostering strategic adherence and sustainable success. Each perspective on a Balanced scorecard used in banking institutions has a different focus.

- Financial Perspective: This perspective concentrates on traditional financial metrics, such as profitability, Return on Investment (ROI), revenue growth, and cost-effectiveness. It ensures that the organisation's financial goals align with its overall strategy and mission.

- Customer Perspective: This perspective focuses on customer satisfaction and loyalty and evaluates the organisation's performance from the customer's viewpoint. Key indicators may include Customer Satisfaction Scores (CSAT), Customer Retention Rates (CRR), market share, and the Customer Acquisition Cost (CAC).

- Internal Processes Perspective: This perspective examines the efficiency and effectiveness of the internal processes critical to achieving the financial organisation's objectives. Key metrics may involve process cycle time, quality measures, cost efficiency, and innovation in product or service delivery.

- Learning & Growth Perspective: Focusing on the ability to innovate, develop, and adapt, this perspective emphasises human capital, technology, and organisational culture. Key indicators include employee training and development, employee satisfaction, technological advancements, and the ability to foster a culture of continuous improvement.

How to implement the Balanced Scorecard Software in a Banking Institution?

A banking institution can implement the Banking Balanced Scorecard

Key Performance Indicators (KPIs) in a Balanced Scorecard for Banking Sector

- Return on Assets (ROA): ROA is a vital financial indicator measuring the bank's ability to generate profit from its assets, providing insights into operational efficiency and asset utilisation.

- Customer Satisfaction Index (CSI): This KPI assesses customer satisfaction levels, reflecting the bank's success in delivering quality services and meeting customer expectations.

- Loan Portfolio Quality: Examining the quality of the loan portfolio helps gauge credit risk and asset quality, which is crucial for maintaining financial stability in the banking sector.

- Net Interest Margin (NIM): NIM is a financial metric indicating the profitability of lending activities, calculated as the difference between interest income and interest expenses.

- Risk-Adjusted Return on Capital (RAROC): RAROC considers the risk associated with different business activities, aiding in optimising capital allocation for maximum returns while managing risk exposure.

- Loan-to-Deposit Ratio (LDR): LDR measures the bank's reliance on loans to fund its operations, providing insights into liquidity and risk management strategies.

- Net Promoter Score (NPS): NPS assesses the likelihood of customers recommending the bank to others, reflecting overall customer loyalty and advocacy.

- Digital Channel Adoption Rate: Reflecting the bank's success in embracing digital banking trends, this KPI measures the percentage of customers utilising online and mobile channels.

- Fraud and Security Incident Rate: Monitoring the frequency of fraud and security incidents is crucial for safeguarding customer trust and the overall integrity of banking operations.

- Capital Adequacy Ratio (CAR):

How often should the institution review its Balanced Scorecard?

In the banking sector, it is recommended to conduct regular reviews of the Balanced Scorecard to ensure alignment with dynamic market conditions and strategic goals. Best practices involve quarterly assessments to monitor Key Performance Indicators (KPIs) related to financial performance, customer satisfaction, operational efficiency, and risk management. Frequent reviews allow prompt identification of areas needing attention and facilitate timely corrective actions. An annual review of the banking institution's performance and management processes ensures continuous improvement and strategic relevance.

Is it possible to make a detailed Financial Report using the Balanced Scorecard Software?

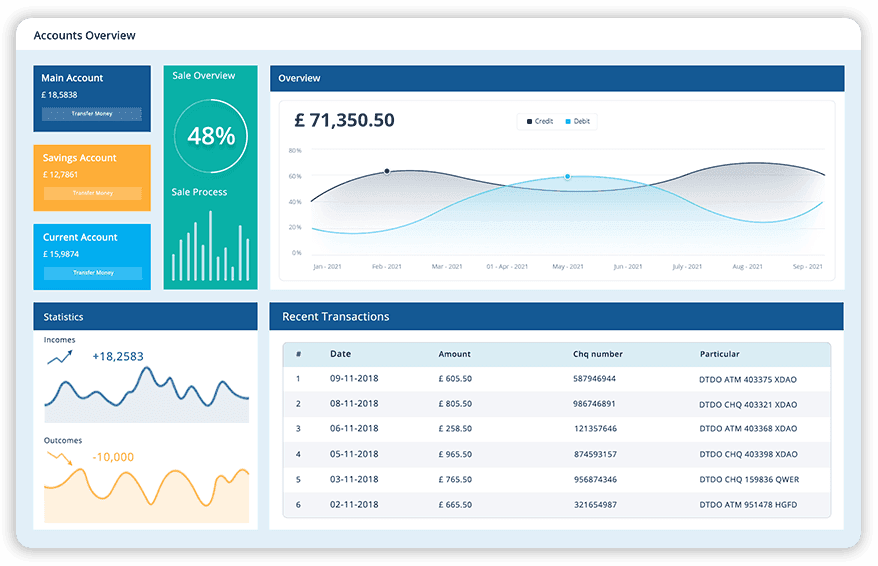

Banking Balanced Scorecard software can facilitate the creation of detailed financial reports, including balance sheets and performance reports. The software consolidates financial data with its integrated capabilities, providing a comprehensive overview of key financial metrics. Users can generate detailed reports on various financial aspects, allowing for in-depth analysis and strategic decision-making. This approach aligns financial goals with overall strategic objectives, fostering an informed financial management strategy.

Digital Balanced Scorecard as a tool for benchmarking and competitive analysis in Financial Organisations

Digital Banking Balanced Scorecards is a powerful tool for benchmarking and competitive analysis in financial organisations. By leveraging real-time data and analytics, these digital scorecards enable financial institutions to compare their performance metrics against industry benchmarks and competitors. This facilitates a more accurate assessment of strengths, weaknesses, and improvement areas, contributing to informed decision-making. The digital visualisation allows for updates, ensuring that benchmarking is dynamic and reflective of the rapidly evolving financial landscape. Additionally, this visual management tool