FAQs

1. When should I conduct a Gap Analysis in my business cycle?

A Gap Analysis is most useful during planning cycles, before launching new strategies, when performance issues arise, or when a business is scaling. It's also ideal after audits or organisational changes to identify areas needing improvement.

2. How long does a typical Gap Analysis take?

It depends on complexity. A simple team-level Gap Analysis might take a few days, while a company-wide strategic analysis may take weeks—especially if done manually. Using advanced digital tools, however, significantly reduces time by automating data capture and tracking through comparing specific KPIs, resource availability, or compliance criteria.

3. What should a Gap Analysis report include?

A complete report should cover:

- Desired outcomes or benchmarks

- Current performance data

- Identified gaps

- Root causes

- Priority level of each gap

- Recommendations

- Assigned actions or next steps

4. Is it better to do Gap Analysis manually or digitally?

Manual Gap Analysis is prone to error and time delays. Advanced digital tools ensure accuracy, provides visibility across teams, and enables faster action with real-time updates.

5. How do I prioritise which gaps to close first after gap analysis?

Rank gaps based on impact vs. effort. Look at how each gap affects critical business goals, then consider available resources and timeframes. High-impact, low-effort gaps are the best starting point.

6. Can different departments use different Gap Analysis methods?

Yes. HR might use a skills Gap Analysis, while operations might use benchmarking or process flow reviews. The method should suit the nature of the work and goals of the department.

7. How often should Gap Analysis be done?

It depends on your industry and goals, but most organisations conduct a Gap Analysis quarterly, annually, or at the start of new strategic initiatives.

8. Can Gap Analysis be repeated across different time frames?

Yes. You can conduct quarterly, biannual, or project-based Gap Analyses to track progress over time. Many organisations build Gap Analysis into their strategic review cycles.

9. What’s the difference between Gap Analysis and root cause analysis?

Gap Analysis identifies what the difference is between the current and desired state. Root cause analysis investigates why those differences exist.

10. Is Gap Analysis only for large organisations?

Not at all. Small and medium-sized businesses can use Gap Analysis to focus their limited resources where they’ll make the biggest impact—whether that’s people, processes, or systems.

11. Can I link Gap Analysis results to my balanced scorecard?

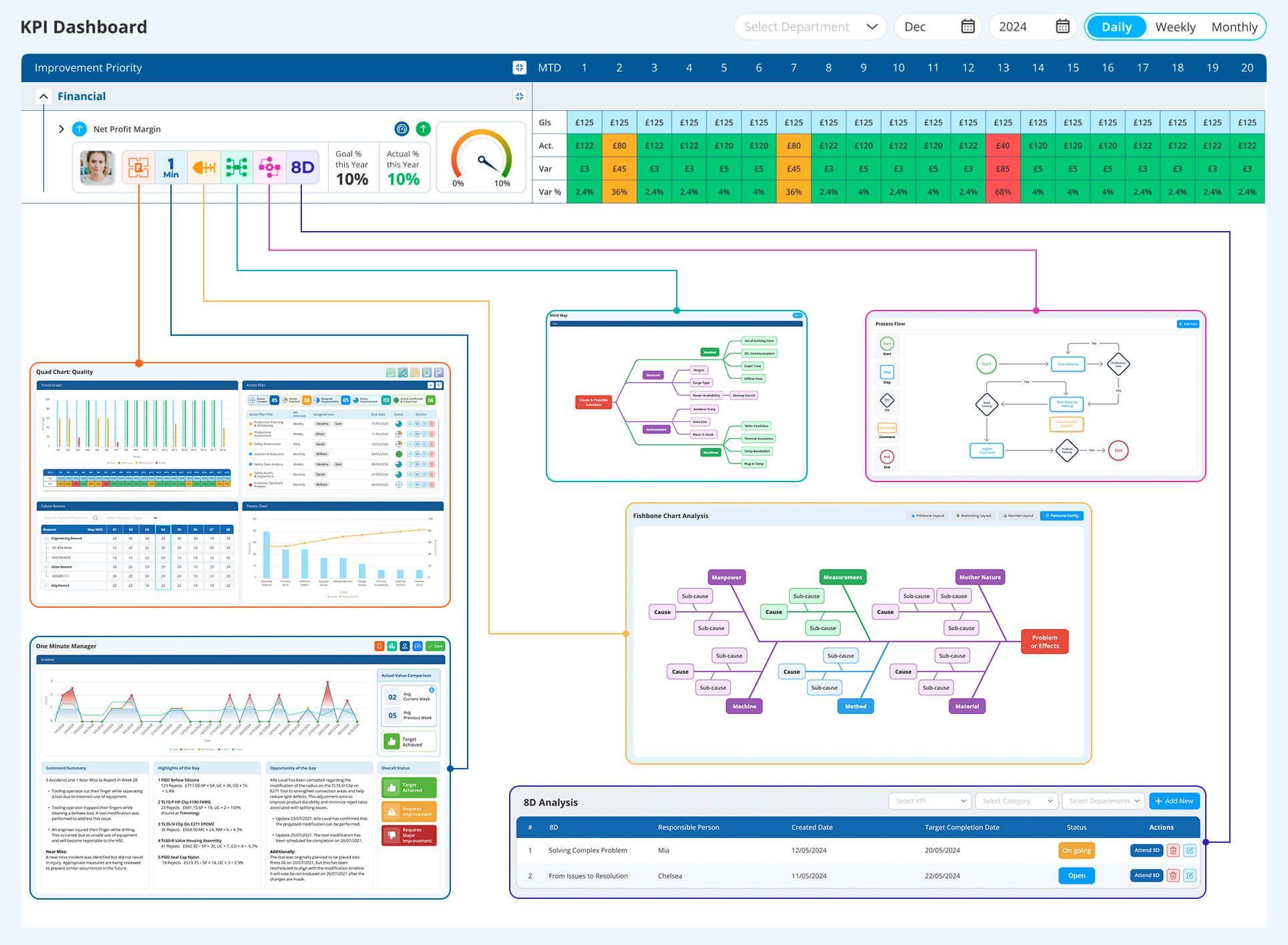

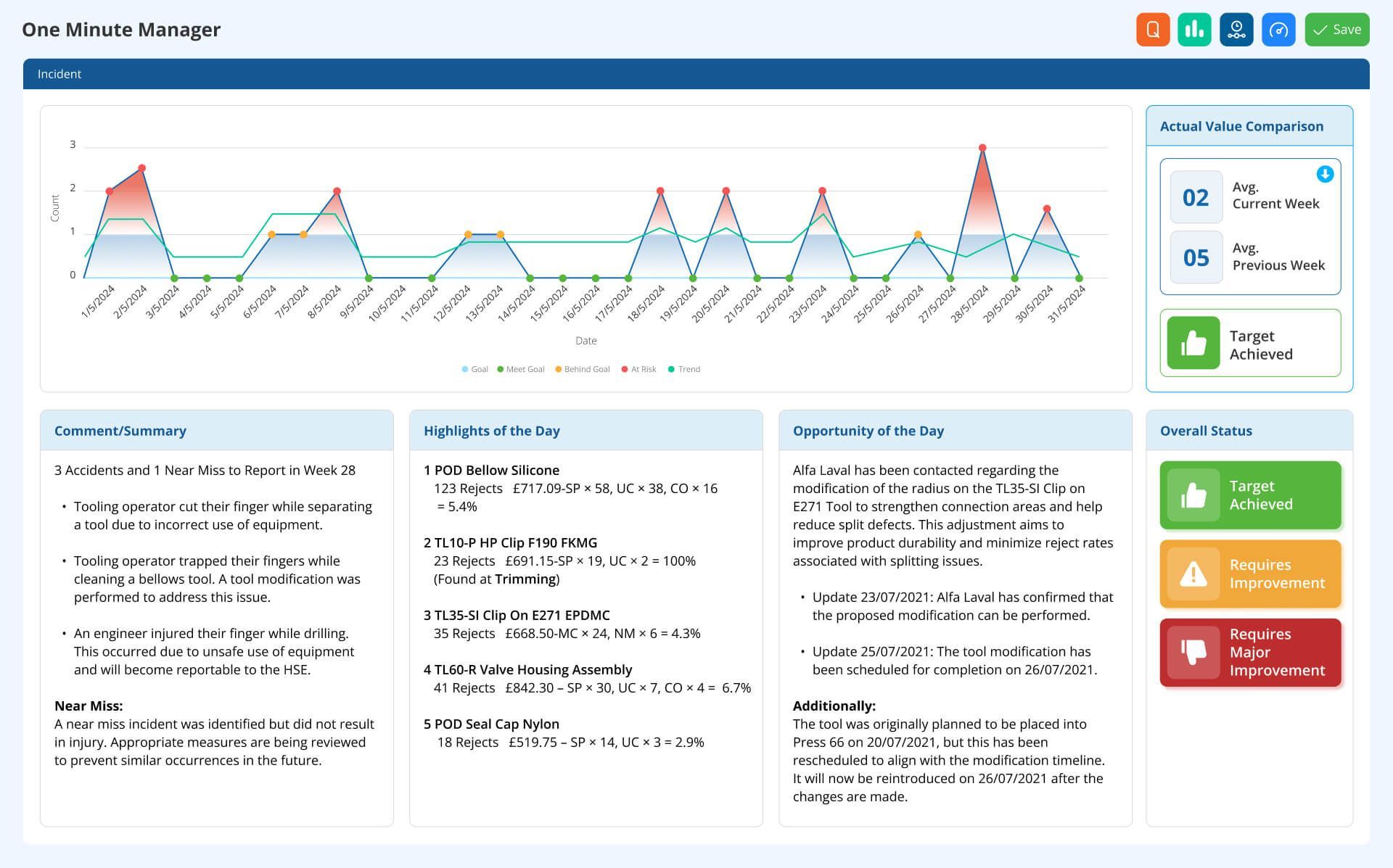

Absolutely. In fact, it's highly recommended to use a digital Balanced Scorecard. Platforms like Data Point Balanced Scorecard ssoftware allow you to directly connect gap insights to KPIs on your balanced scorecard, improving alignment and execution.

12. Can Gap Analysis be automated?

Yes. Using digital platforms like Data Point, you can automate tracking, visualise performance gaps, and manage action plans in real time.

13. How can I track progress once a gap has been identified?

Use a platform like Data Point Balanced Scorecard software to assign ownership, set deadlines, and monitor real-time progress on closing performance gaps through integrated dashboards.

14. Is there a standard Gap Analysis template I can use?

Yes. You can use structured templates that outline your objectives, current vs. desired state, gaps, root causes, and action plans. Platforms like Data Point offer customisable digital Gap Analysis templates for easier execution and tracking.

15. Can I customise a Gap Analysis template for different departments?

Yes. Different teams have different goals and metrics. With Data Point, you can build tailored templates that match departmental KPIs, roles, and responsibilities—while still aligning with company strategy.